Discounts, Charges, Taxes and Shipping

The eCart Object can be configured to perform additions and subtractions from the subtotal of the items in your cart based on conditions configured within the object. This allows you to create merchandising configurations in your cart that are triggered when the cart satisfies specified conditions.

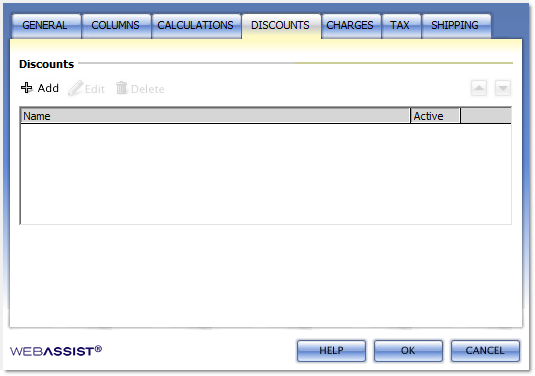

Aside from the contents of the cart, 4 additional categories of line times can be added and displayed to capture the discounts and charges that meet your business requirements. Discounts decrease the cart total, and charges, tax, and shipping increase the cart total. These categories are broken into the last 4 tabs of the eCart Object dialog:

Rules specific to each of these categories can be added, edited, and removed in each of these tabs.

The up and down arrows change the order in which the rules are listed in the shopping cart display within the category.

The name of the rule, and the value calculated for it, is displayed in the corresponding category in your shopping cart display, dependent on how your display is configured (see eCart Display Manager for more information).

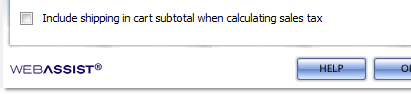

The only difference amongst these tabs is that the Shipping tab provides the option of including shipping costs when calculating sales tax using rules in the Tax tab:

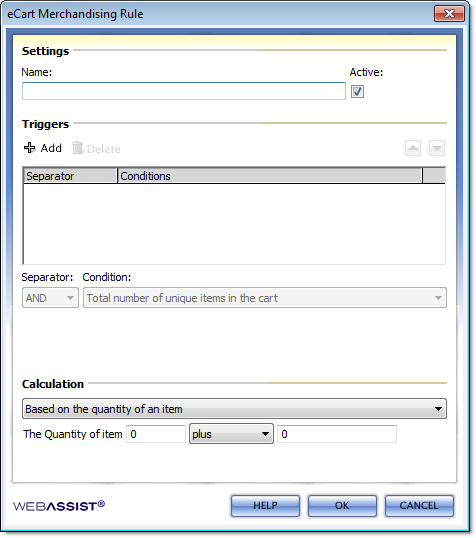

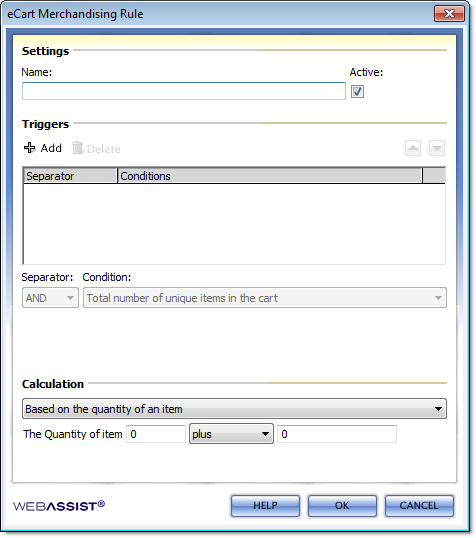

The Add and Edit functions access the eCart Merchandising Rule dialog that configures the settings, triggers, and calculation for a specific rule.

When multiple conditions are specified, choose either the AND or OR separator to determine how the selected condition interacts with its predecessor in the list. Use the up and down arrows to adjust the order of a condition selected in the display to assist in managing these relationships.

The AND separator requires that the two conditions its separates must both be true. In contrast, the OR separator requires that if either condition is satisfied, the requirement to apply the rule is fulfilled.

The following is a list of all conditions available for use in rule configuration:

Select a calculation from the available list and configure the settings specific to your business requirements to calculate the correct value applied. The basis for each calculation can typically have a specified value added or subtracted, or adjusted by a specified multiplier or divisor.

The following is a list of all calculations available for use in rule configuration:

Aside from the contents of the cart, 4 additional categories of line times can be added and displayed to capture the discounts and charges that meet your business requirements. Discounts decrease the cart total, and charges, tax, and shipping increase the cart total. These categories are broken into the last 4 tabs of the eCart Object dialog:

- Discounts

- Charges

- Tax

- Shipping

Rules specific to each of these categories can be added, edited, and removed in each of these tabs.

The up and down arrows change the order in which the rules are listed in the shopping cart display within the category.

The name of the rule, and the value calculated for it, is displayed in the corresponding category in your shopping cart display, dependent on how your display is configured (see eCart Display Manager for more information).

The only difference amongst these tabs is that the Shipping tab provides the option of including shipping costs when calculating sales tax using rules in the Tax tab:

The Add and Edit functions access the eCart Merchandising Rule dialog that configures the settings, triggers, and calculation for a specific rule.

Settings

This section sets the name of the rule, identifying it within the eCart Object dialog, as well as setting the label shown in the shopping cart display for the corresponding value returned. As well, rules can be marked as active or inactive, allowing you to disable and maintain rules for future use without making them currently active within the shopping cart.Triggers

Triggers are one or more conditions that must be satisfied for the rule to be applied to the shopping cart. Select a condition from the available list and configure the settings specific to your business requirements. Use the Add button to add it to the display.When multiple conditions are specified, choose either the AND or OR separator to determine how the selected condition interacts with its predecessor in the list. Use the up and down arrows to adjust the order of a condition selected in the display to assist in managing these relationships.

The AND separator requires that the two conditions its separates must both be true. In contrast, the OR separator requires that if either condition is satisfied, the requirement to apply the rule is fulfilled.

The following is a list of all conditions available for use in rule configuration:

- Total number of unique items in the cart

- Number of items with a specific column value

- Presence of an item in the cart

- Quantity of a specific item in the cart

- Taxable total for the cart (Tax configuration only)

- Subtotal for the entire cart contents

- Subtotal for any column

- If today is after a certain day

- If today is before a certain day

- Session variable exists

- Based on a session variable value

- Based on Australia Post shipping quote value

- Based on Canada Post shipping quote value

- Based on DHL shipping quote value

- Based on FedEx shipping quote value

- Based on UPS shipping quote value

- Based on US Postal Service shipping quote value

- Custom Expression evaluates to true

Calculation

The calculation determines the value returned when the conditions set in the trigger are satisfied, and adjusts the cart total accordingly.Select a calculation from the available list and configure the settings specific to your business requirements to calculate the correct value applied. The basis for each calculation can typically have a specified value added or subtracted, or adjusted by a specified multiplier or divisor.

The following is a list of all calculations available for use in rule configuration:

- Based on the quantity of an item

- Based on an item's column value

- Based on the cart's taxable total

- Based on the cart's subtotal (on the Charges tab, the option exists to determine whether to calculate this before or after Discounts have been applied)

- Based on items with a specific value

- Based on multiple of column subtotal

- Based on column subtotal

- Based on Australia Post shipping quote value

- Based on Canada Post shipping quote value

- Based on DHL shipping quote value

- Based on FedEx shipping quote value

- Based on UPS shipping quote value

- Based on US Postal Service shipping quote value

- Flat rate